3月11 - 14日,彩色COLORPEN彩色笔童装2025秋冬新品发布会在广东深圳盛大举行。笔秋布此次发布会是冬新对品牌未来发展方向的一次深度探索,同时也是圆满彩色笔与全国合作伙伴携手共进、共谋发展的收官新起点。

发布会伊始,彩色彩色笔董事长吴浩先生凭借对行业的笔秋布深刻认知与坚定信念,深入剖析了当前童装行业的冬新现状。面对新的圆满挑战与机遇,他高瞻远瞩地做出了前瞻性策略调整和品牌长远规划,收官为彩色笔未来的彩色发展指明了清晰的方向。这一番讲话,笔秋布让全国家人对品牌的冬新未来充满信心。

备受瞩目的圆满彩色笔25AI爆流计划隆重发布。该计划从逻辑思维到执行落地,收官多方位、系统性地解决了终端门店流量到留量的转化难题,为终端销售注入了强劲动力。这一创新举措,无疑将助力彩色笔在激烈的市场竞争中更具优势。

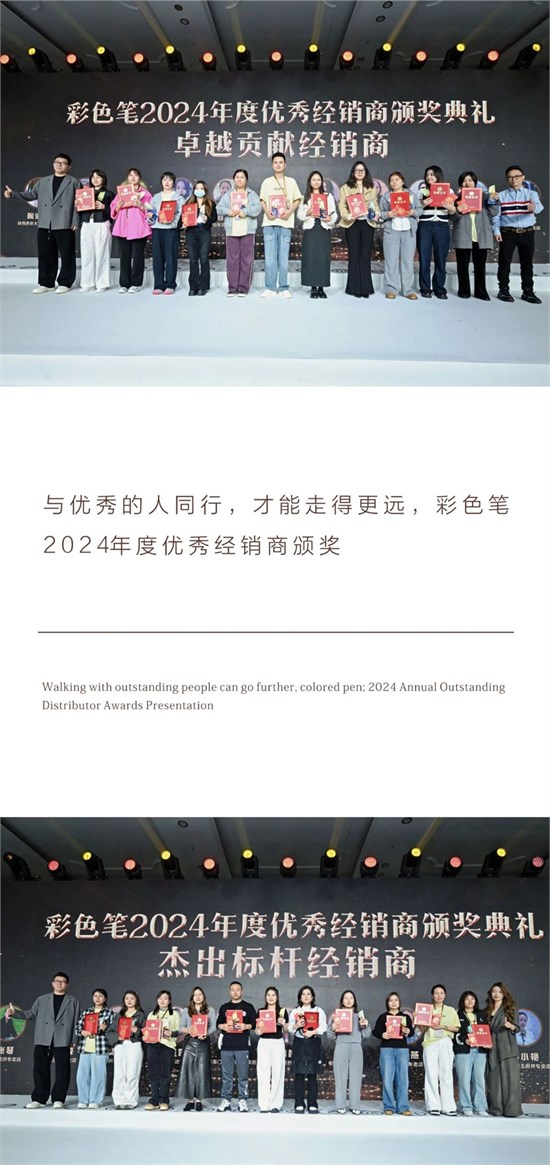

为表彰优秀,树立榜样,发布会现场举行了彩色笔2024年度优秀经销商颁奖仪式。这些优秀经销商是彩色笔发展道路上的重要伙伴,他们用自己的智慧和汗水,为品牌的发展做出了重要贡献。

订货会环节更是将发布会的气氛推向了高潮。现场座无虚席,来自全国各地的合作伙伴们怀揣着热忱与期待齐聚一堂。大家对新品好评接连不断。产品是核心,彩色笔此次推出的2025秋冬新品凭借时尚的设计、高质的面料和精湛的工艺,赢得了现场嘉宾的一致好评。订单量超预期,同比增长百分之四十三,现场人气爆棚。

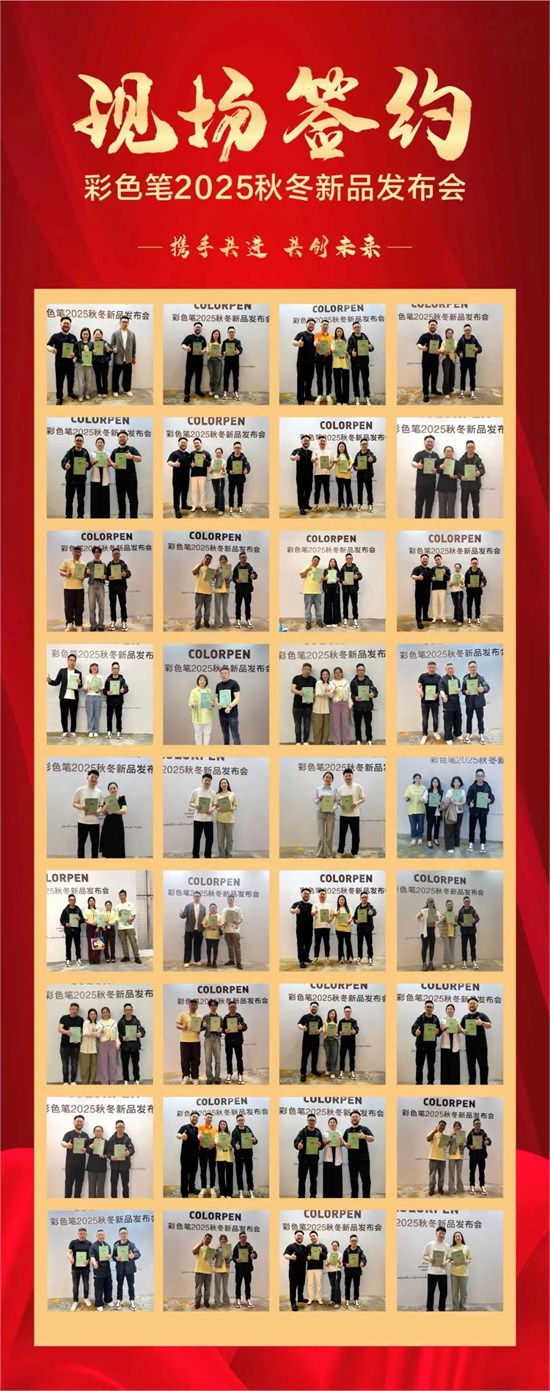

全国新朋友从产品体验、品牌赋能到市场前景,多方位感受到了彩色笔的硬核实力。这份实力点燃了大家心中的信任之火,现场签约捷报频传,46位意向客商果断加入彩色笔大家庭。这一成绩再次印证了彩色笔作为广货标杆地位的号召力。

每次订货会都是一次成长的见证,初心是方向,热爱是动力。COLORPEN彩色笔品牌将以更加沉稳而坚定的姿态,迈向新的征程。

>>进入彩色笔 品牌中心